Like most commercial property owners in Juneau, PeggyAnn McConnochie is smarting from her tax bill this year after the city raised the assessed value of commercial land by 50%.

“My husband and I own the building that’s also known as Cycle Alaska building, and it is a building that we are appealing the 2021 assessed values on right now,” she said.

Unlike other commercial property owners, McConnochie is also a real estate broker who teaches classes for other real estate professionals.

City officials say this increase is just the first step in a multi-year correction to fix a decade of “neglect” in the annual assessments of commercial properties. Those values directly impact tax bills, and the balance of who’s paying for city services.

McConnochie and the owners of hundreds of other affected properties think this first jump already over values their holdings, and they’re fighting it.

Every April, the Juneau Assessor’s office mails out its new assessed values to property owners. McConnochie’s mailer for this year puts the value of the lot that the bike shop sits on, which is about a sixth of an acre and zoned waterfront commercial, at $463,050. That’s 50% higher than last year. That also means she owes about $1,600 more in property taxes this year.

“It’s not something that makes me kind of happy,” she said.

The assessed value of McConnochie’s property is $1,228,950 after the building is factored in.

“If my property was worth over a million bucks, I’d say I’d put it on the market today and try to sell it,” she said. “Although, there’s no market for it up.”

McConnochie said that’s one of the problems with the assessor’s methodology. She and other property owners don’t think the new assessments capture how volatile the commercial real estate market is in Juneau. There’s the pandemic, of course. But McConnochie said there’s also been longer economic trends that years of flat assessments did reflect.

“We live on the vagaries of us being the capital city,” she said. “And when you have a capital city that goes through things like, oil was $100 per barrel, but goes down to zero … that affects my business, and my building. Just as it affects most other people’s businesses and other people’s buildings. So that is not necessarily true that the properties go up. He’s wrong.”

The assessor is actually a she, but keeps a low profile because her work is supposed to be free from public and political influence.

Instead, city Finance Director Jeff Rogers has been the public face of the assessment issues. The Greater Juneau Chamber of Commerce invited him to speak about commercial assessments back in April.

“Um, I fully recognize that I normally get invited when uh, people are sort of upset with me, uh, or with something that the city’s doing,” he said after being introduced.

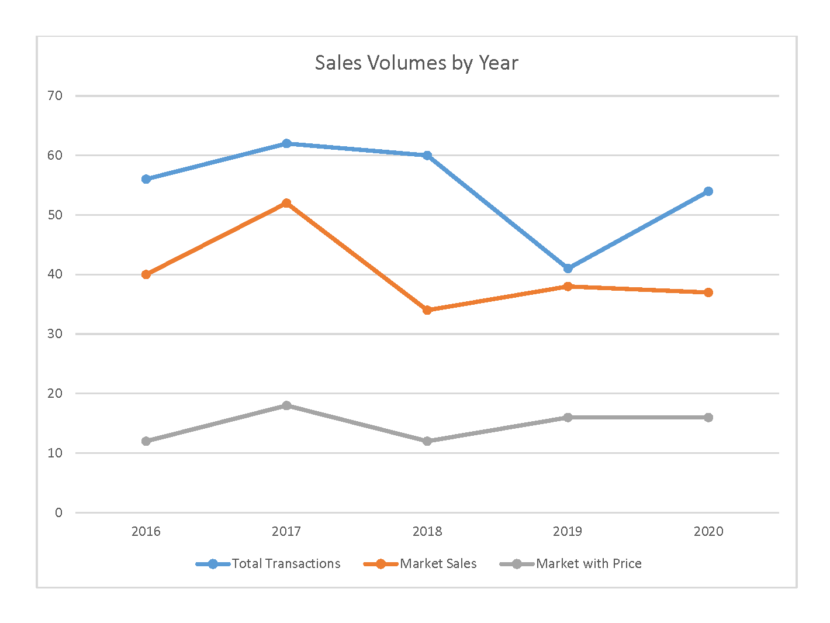

Explaining the correction and justification is complicated and technical. But a big piece comes from a comparison of disclosed sales prices of 57 commercial properties over the last five years against the city’s assessed values. It’s only a partial data set because sale price disclosures weren’t mandatory until a new city law took effect last November.

For commercial properties, sales prices on average were much higher. Rogers said the data indicates that the commercial real estate market isn’t as volatile as unhappy property owners think. Still, the owners of 207 commercial properties filed appeals this year.

“There’s nothing about the appeals that makes me think that we have made a global error,” Rogers said. “We have demonstrated in a number of analyses that the vast majority of commercial parcels have not seen any increase to their base land value in a decade or longer.”

Some of those appeals are being resolved through conversations with the assessor’s office. Most are pending with the Board of Equalization for individual hearings and decisions. The board is a panel of volunteers appointed by the Juneau Assembly.

Rogers said he wants all of the appeals to be fully settled by the end of the calendar year so that the assessor’s office can shift its focus to the 2022 assessments.

But with so many outstanding appeals, it’s not clear if that soft deadline will be met with the regular process. Rogers said lawyers for the city and a group of property owners that includes McConnochie are trying to see if there’s a way to hold a group hearing.

“And then, if the Board of Equalization doesn’t agree, I’m more than willing to go to court,” McConnochie said. “And I gotta tell you, every single one of the people who are on the consolidation list is more than willing to do that, too.”

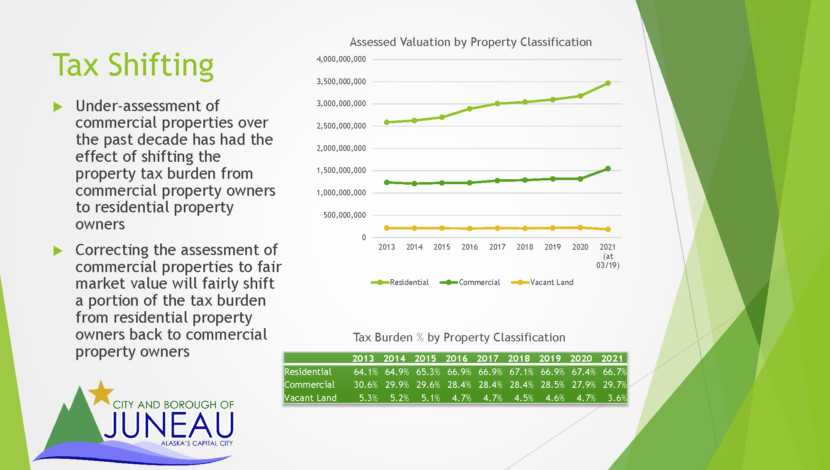

Rogers acknowledged that the abrupt change feels unfair to commercial property owners. But there’s a whole other class of property owners paying more than their fair share, because residential property assessments have been rising more or less in line with actual market values.

“So if you are a residential property owner, and you’ve owned your property over time, you have borne an increasing burden of property tax for the borough for the provision of police and fire and all the other services the city provides, because commercial land has been underassessed,” Rogers said.

Juneau’s local elected officials have been learning about the issue. At a recent Assembly meeting, Mayor Beth Weldon said they don’t have many options to intervene.

“There is limited things that we can do as the Assembly,” she said. “All the Assembly can do is ask the assessor to reassess. And we can’t tell them how, or who or anything. All we can say is, ‘Assessor, please reassess.'”

Weldon warned that could lead to even higher assessments. Or put this year’s assessment, appeal, and tax cycle further behind schedule.

One action the Assembly did take at that meeting was to give property owners a partial reprieve on their tax bills this fall. Normally, a year’s worth of property taxes are due in full at the end of September. This year, only 80% of the bill will be due. Property owners are still on the hook for the rest, but they’ll have three more months to pay that off.

Those due dates apply even if an appeal is pending. But Rogers pointed out that if a property owner wins their appeal and overpaid their taxes, then a state law requires the city to refund excess taxes plus interest at a generous 8% annualized rate.

The Juneau Assembly is discussing the commercial property assessments in a committee meeting Wednesday evening.

Disclosure: Reporter Jeremy Hsieh worked for Cycle Alaska in the summer of 2012.

This article has been updated to include the assessed value of PeggyAnn McConnochie’s property.