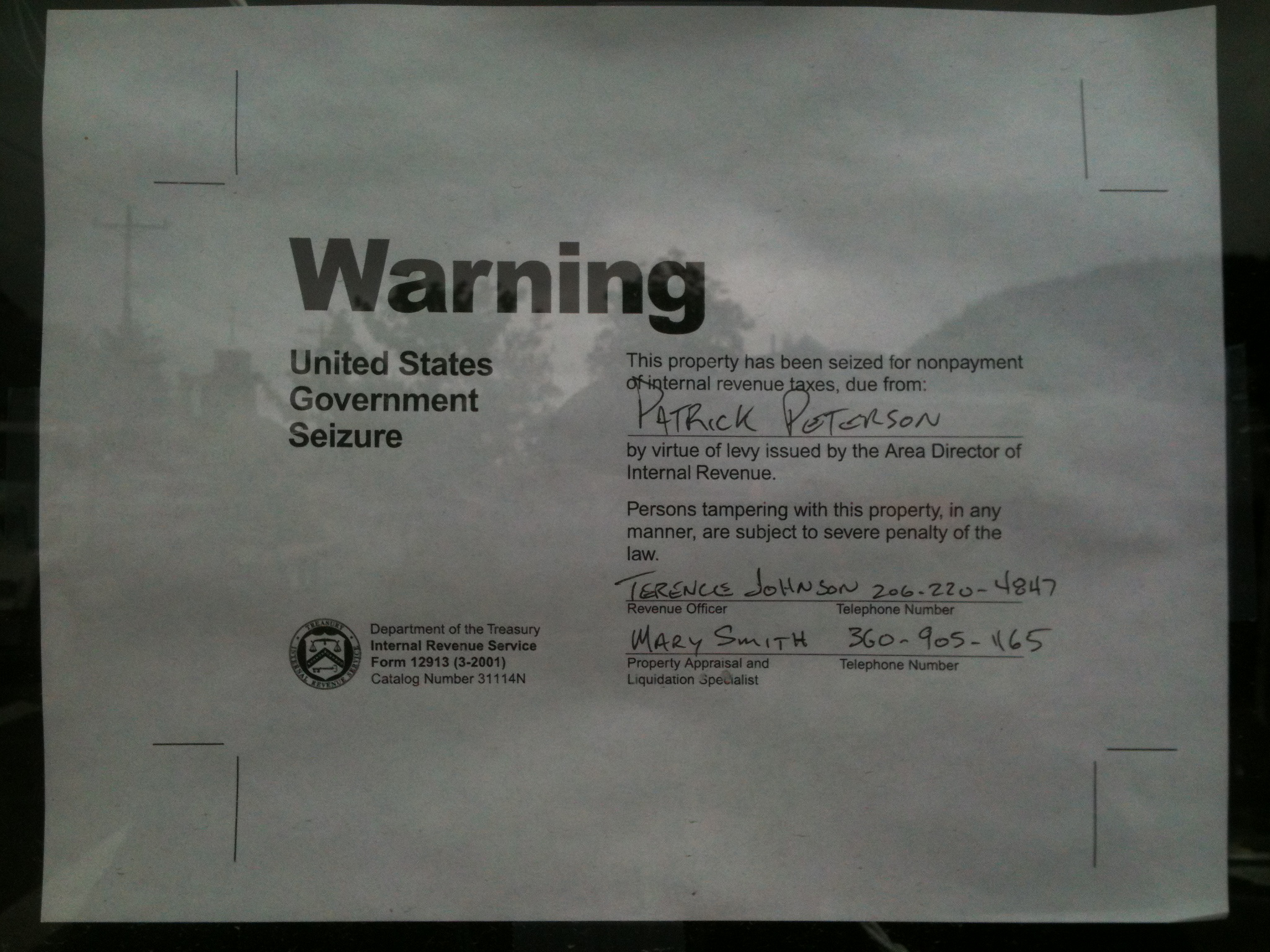

A public auction may be held later this year for a Douglas business that was closed down and seized by the Internal Revenue Service for not paying federal taxes over the last fourteen years.

It’s unclear exactly when P P’s Douglas Inn, formerly known as Louie’s, was closed up by the IRS. Douglas residents reported locked doors, upturned stools on tables, and dimmed lights just before the Independence Day holiday. Owner Patrick M. Peterson remembered during an interview with KTOO on Friday that federal agents closed down the bar sometime in May. He admitted that he did not pay federal taxes.

“Paperwork is not my big suit,” said Peterson. “I just couldn’t keep up with it. Up until 1999, I had a good bookkeeper that was taking care of it for me. So, I had everything caught up with.”

Peterson said he did have others working on his bookkeeping and taxes since then, but he said that “nobody came through with what I needed.”

He also blamed the unpaid taxes on having to cover expenses from as many as four different attorneys to deal with legal issues encountered by him and his daughter.

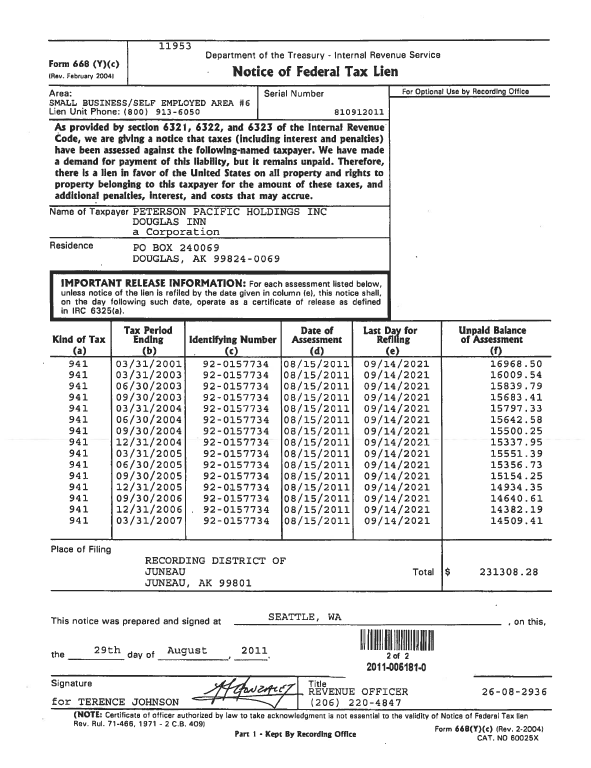

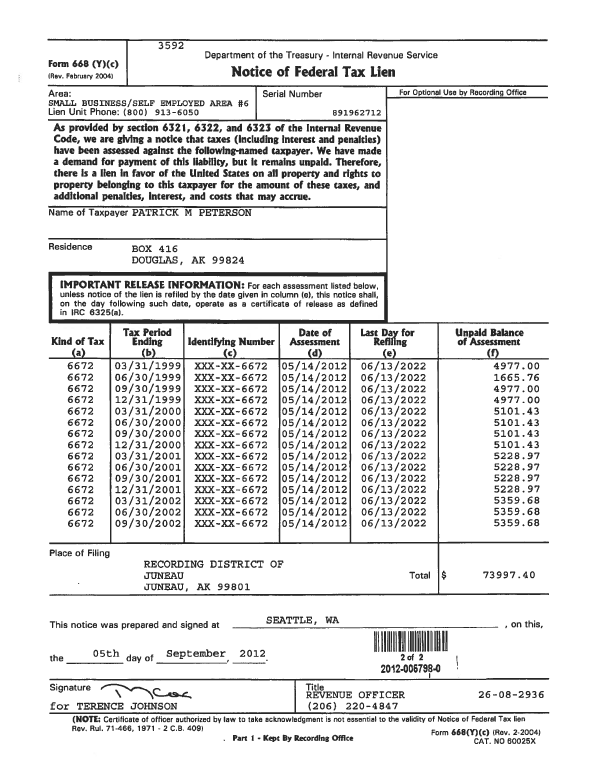

Federal tax records show that Peterson and his company Peterson Pacific Holdings owe nearly $1 million in back taxes. Three-quarters of that amount is in the form of unpaid quarterly employer taxes from early 1999 to the end of 2012. The rest is what the IRS calls a Trust Fund Recovery Penalty, or an attempt to recoup employees’ withholding, Medicare and Social Security taxes that the employer did not pass on to the federal government.

[box type=”shadow”]Eleven federal tax liens totaling $997,188.16 were filed against Peterson and his company between July 2011 and June 2013. They were for unpaid federal employer taxes during most of the reporting periods from First Quarter 1999 to Fourth Quarter 2012.[/box]

State property records indicate that Peterson signed a quit claim deed for the property to Carol Collier of Riverview, Florida in exchange for $1 on May 20, 2013.

It was just a honey I know. I tried to transfer it to protect it, but it didn’t work. The lien was already against the property so it went with it when they transferred it.”

CBJ property assessments show the land valued at $67,900 and the structure valued at $174,100 for a combined total of $242,000.

IRS officials contacted for this story declined to comment on the record because of privacy concerns, and they would not say anything about the procedure for recovering outstanding taxes and the seizure of real property out of worries that any specific inferences could be made to the Peterson case. They also would not answer any questions about why they started placing liens on the property nearly twelve years after the first quarter of unpaid employer taxes.

“That’s letting it go pretty far,” said Professor Scott Schumacher, director of the Graduate Program in Taxation at the University of Washington School of Law. He also worked as a trial attorney for the U.S. Department of Justice’s Tax Division, and represented clients on federal tax issues as a private attorney.

You can see that there’s been a problem with that business since 1999. We’re going on close to fifteen years and they’ve likely been working with someone (at the IRS). I’ve seen it go back several years, but it’s rare that they would let it go that long.”

Schumacher said continued non-payment of such taxes is common, especially among struggling businesses.

If a business is in financial trouble and they have cash flow issues and they’re saying ‘OK, if I don’t pay my suppliers, they’re not going to give me any inventory. If I don’t have any inventory, (then) I’m out of business. Just one quarter or one month and I’ll do better, and the IRS isn’t going to shut me down.’ So they think. That’s kind of how it works. Then they think ‘OK, all I need to do is get through this month and I’ll be fine.’ Of course, oftentimes that doesn’t work.”

Schumacher said that the IRS is usually in contact with the taxpayer with almost-immediate notices. Field staff are usually assigned to work with taxpayers and help them get caught up on back taxes. But he calls the eventual measures that were taken in Peterson’s case as an extraordinary step.

Shutting down of a business or seizure of a business is very rare.”

IRS officials would only say that there will be a notice published in the local newspaper of the public auction of the property. Peterson said that he still planned on getting his business back.

This is not the first time that Peterson has gotten into trouble for not paying taxes. Last year, he was sentenced to serve eighty days in jail for pocketing City and Borough of Juneau sales taxes. Prosecutors recently agreed to cut his probation to three years after he paid the city back $54,738.16, proceeds from the recent sale of a family farm that he inherited following the passing of his father. Court records indicate that Peterson actually paid a lump sum that included interest of $58,220.87 directly to the CBJ on March 31, 2013.

Peterson had the same issue with not paying city sales taxes ten years ago. He was convicted on March 26, 2003 of four counts of failing to file sales taxes, but acquitted of four counts of failing to remit sales taxes. He was ordered to serve a combined, partially concurrent sentence of 330 days in jail with 315 days suspended, and ordered to pay $3500 in fines with $3200 suspended. The sentence included a provision allowing him to serve out the 15 days of unsuspended jail time as 120 hours of community work service, and he was ordered to serve five-years on probation.

Court records are incomplete in that case and do not show exactly how much in sales taxes that Peterson allegedly did not remit to the CBJ, but he allegedly failed to submit sales fax forms for the Third Quarter 2000, and First, Second, and Third Quarters of 2002.

Peterson did not last very long on probation. On three separate occasions starting the following year (March 25, 2004, Sept. 23, 2004, and April 22, 2005), city prosecutors successfully moved for revocation of his probation because of unpaid sales taxes. Some of the evidence included two late-filed sales tax forms. One was for $5561 of sales taxes on $46,225 in liquor sales and $58,284 in other sales during the First Quarter of 2004. Another late-filed form showed a partial remittance of $1438.75 for the Second Quarter of 2004.

In almost every instance, Peterson received a sentence of a suspended fine (He was ordered to pay $100 in April, 2005) and minimal jail time of one- to four-days that could be served with an equivalent of community work service.

State records also indicate that a judgment of foreclosure was issued five times between 2003 and 2008 for unpaid CBJ property taxes. Although, Peterson did come up with past-due taxes during at least of one of those years.

State liens were also filed against the bar for unpaid unemployment insurance contributions between 2007 and 2013, although it appears that most of those liens were relinquished whenever Peterson handed over the several hundred dollars that were due.