The Mustang Field is pretty unremarkable — in that it looks like the rest of the North Slope. Flat tundra stretches as far as the eye can see — and on top, all the signs of the oil industry. There’s a long gravel road, a big pad and some equipment.

What is remarkable about this field is the type of investment it has gotten in the past decade. Specifically, about $95 million dollars in state or state-backed loans.

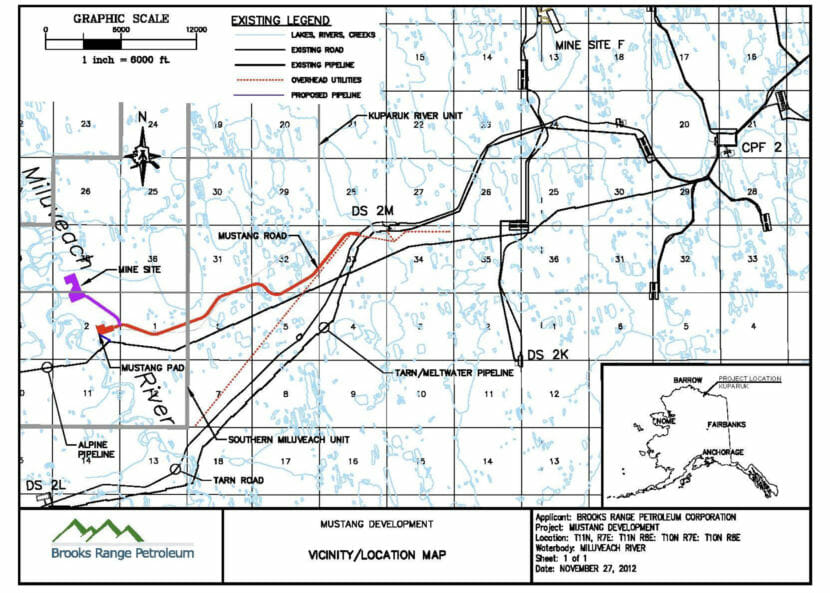

But, this is not a story about a field that doesn’t have any oil. This field is nestled between two very productive ConocoPhillips units. One — Kuparuk — is the second largest oilfield in North America. Mustang is estimated to hold more than 25 million barrels of oil.

Instead of being operated by one of the major players on the North Slope, it is run by a small, 13-year-old, independent oil company — Brooks Range Petroleum Corporation.

The company plans to hire a few hundred people this winter to put in a small, quick production facility and start producing in early 2019. Its president and CEO Bart Armfield said oil is coming soon.

But it has taken the better part of a decade to get to this point. There is a long paper trail at the Department of Natural Resources showing years of work delays.

Ask Armfield about the company’s plans and those delays and he has a quick answer.

“What happened to the whole industry? Oil prices fell from $120 plus to $30 a barrel,” Armfield said.

It’s a refrain Alaskans have been hearing for three years. In 2014, oil prices started to fall and it wrecked the state’s budget. Financing projects in the oil patch got trickier too.

Armfield’s not blaming all of the project’s delays on low oil prices — there were some technical problems too. But he said that crash put Brooks Range Petroleum in a holding pattern.

But now, oil prices have rebounded somewhat and the Mustang Field could be well on its way to paying off some of its bills next year. There are a lot of outstanding bills and untangling who exactly is responsible for paying what back, is not easy.

For starters, Brooks Range Petroleum operates the Mustang Field project — but it does not fully own it.

Just who owns which part is a web of companies and subsidiaries and right in the middle is AIDEA, the Alaska Industrial Development and Export Authority. It’s the state corporation that finances in-state projects.

When AIDEA bought into the Mustang field in 2013 — it tried something different. Instead of just investing or loaning money to the field – AIDEA formed a corporation. That AIDEA-owned corporation built the road and pad leading out to the Mustang field.

AIDEA did it again a year later. It formed another corporation to build an oil processing facility. Altogether, the state corporation put about $72 million into developing and maintaining the Mustang Field.

But, by 2015 there was still no oil coming out of it — that means no money coming in to recoup AIDEA’s investment. Oil prices were in a free-fall. That’s when the Department of Revenue stepped in, specifically the state treasury, and floated one of those state-owned corporations a $22.5 million line of credit. Think of it as a bridge loan, something to keep the Mustang Field afloat until things got better.

Because that company was 96% owned by AIDEA, what happened was basically one part of the state loaned money to another part of the state. Also, the collateral for that loan was oil tax credits that the state’s tax division owes to the corporation.

That’s convoluted, but basically it means that the state and a state-owned corporation carry almost $95 million worth of debt and nearly all of the risk of default on that debt for the Mustang Field.

This was — and still is — unusual. The Mustang field is the only one to get a loan like that from the treasury. In fact, the treasury made the loan out of a portion of the state’s general fund, then changed its rules several months later to say that it was OK to invest state money in that type of loan.

Right now, there isn’t a lot of documentation that explains why that loan was made. Over at the Department of Revenue, Deputy Commissioner’s Mike Barnhill has been trying to sort it out.

Barnhill wasn’t in that position when his department made the loan. When he started in January, he says staff flagged it for him. because it was due to be paid in July.

He pulled the file and there isn’t a lot of information in it about the origins of the loan.

“I have, I believe, reviewed all of the files within the Department of Revenue. There’s a pending public records request for emails, that I don’t have access to. So it may be that those emails reveal the genesis of the idea,” Barnhill said.

That public records request came from Jeff Landfield, a blogger who runs the site Alaska Landmine. Landfield said he doesn’t understand why the state would make a loan to bail a state-backed company out.

“So, I started digging into it and trying to figure out what happened,” Landfield said. “The more I dug into it the more I realized it was like… I think ‘fishy’ is a good term, you know?”

Landfield works in the oilfield support industry and said he considers it blatant favoritism. He wants to know why that loan wasn’t offered to any other companies when oil prices were down and the industry was suffering.

“If you’re involved with AIDEA and you’re in a project, you’ll get a bailout,” Landfield said. “Where all the other companies who have a lot more money who stand to lose more — who don’t have the ‘in’ with somebody in the government or the state, you know one of the company’s I talked to said where’s our f– bailout?”

Landfield’s request for those emails is making its way through the state’s Department of Law.

Senator Bert Stedman, R-Sitka, also wants to know why that loan was made. He’s launched a legislative audit.

That audit might take a while, but Stedman said that’s ok.

“I don’t think it’s as time-sensitive to get it out because the program is no longer in existence. Don’t misinterpret that as slow-rolling going out of the auditing department, that’s not the case. But it’s not… the house isn’t on fire.”

Stedman says it can’t be changed now, but he thinks Alaskans should know how their money was spent.

“I don’t think we need to make excuses, you know, why this project was done. It was done,” Stedman said. “Now we just need to, you know, clarify. You know what was done and and what kind of policy direction we’re going in and clean up the mess. You know all of the players are changed. So, it’s not a hanging party you know it’s just .. sort it out and go on.”

That loan still hasn’t been paid back, and it’s not clear when that’s going to happen.

The Department of Revenue asked AIDEA to take over the loan — but that hasn’t happened. For now, Barnhill said there’s a deal in the works to extend the payment deadline. But, that’s complicated too.

The current deal goes something like this: the tax division of the Department of Revenue owes the AIDEA-owned company about $20 million in tax credits. But, that money is currently tied up in court. When that court case gets resolved and those funds get released, the Department of Revenue will hang onto the money and pay itself back. Or, the loan could be extended until December of 2020 — whichever happens first.

It’s not just the treasury that wants out from under its loan to the Mustang Field. The AIDEA board voted to sell its ownership interest too.

That leaves ownership and operation to a handful of companies and Brooks Range.

Brooks Range CEO Bart Armfield is okay with that. He said that Brooks Range has a clear path to getting its oil out of the ground and is well on its way to making some money so it can pay its bills.