UPS and Delta Air Lines oppose a proposal to triple the state’s jet fuel tax. But the Alaska Trucking Association supports a similar increase on fuel for cars and trucks.

UPS representative Jeff Wafford said raising the tax will make Alaska less competitive. He says it could encourage companies to shift to newer jets that can fly directly to Asia.

“If higher costs cause carriers to fly elsewhere, this will indirectly lead to either a reduction in revenues or to the remaining carriers having to pay more into the system to account for those who bypass Alaska,” Wafford said.

Wafford spoke during a Senate Finance Committee meeting Monday.

Dana Debel, a lobbyist for Delta, said Alaska is already a difficult business climate for airlines.

“Last year, we attempted to operate year-round Seattle-to-Juneau, and despite putting forth our best effort there, could not make that financially viable,” Debel said.

Estimates show the tax hike would cost airlines $2 per passenger for Seattle to Juneau flights.

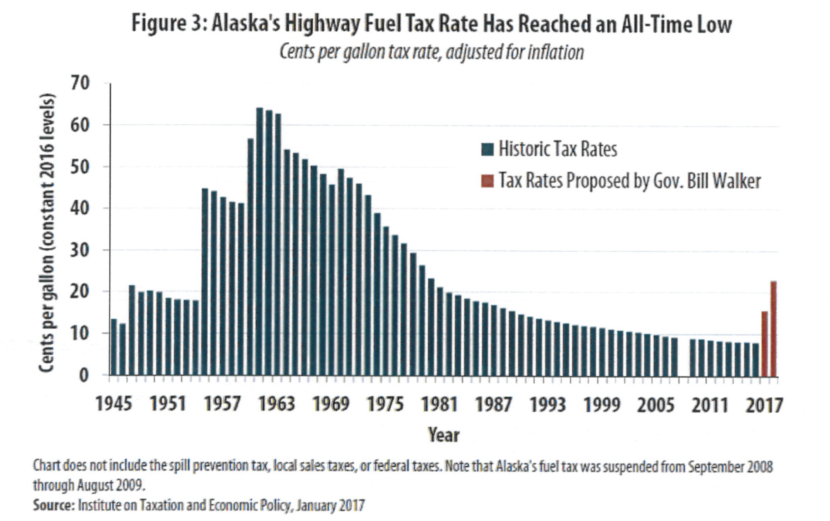

Alaska currently has the lowest fuel tax for gasoline and diesel for cars and trucks at 8 cents per gallon. Under Senate Bill 25, these fuels would increase to 16 cents in July and 24 cents a year later. Maritime, jet, and aviation fuel taxes are closer to the national average. They would also triple.

The bill would designate each type of tax to support maintenance for infrastructure related to each type of transportation.

Not all businesses oppose the increase. UPS supports the fuel tax hike for cars and trucks. So does the Alaska Trucking Association. Association Executive Director Aves Thompson said the tax should be part of an overall plan to balance the state’s budget.

“We believe that action is critical in this legislative session,” Thompson said. “The Alaska Trucking Association has long supported a highway motor fuel tax increase – if the funds could be dedicated to transportation needs.”

The Alaska Constitution bars taxes from being dedicated to fund specific uses, but they can be designated less formally.

The Senate Finance Committee is continuing to discuss the bill. The House version of the bill, House Bill 60, has been referred to the House Finance Committee.