Gov. Bill Walker voiced concerns about changes in the types of oil and gas companies that would benefit from state tax credits under a bill the House Rules Committee unveiled Tuesday.

The bill also received a cool reception from industry, but it may be the best chance to resolve one of the thorniest issues facing the state.

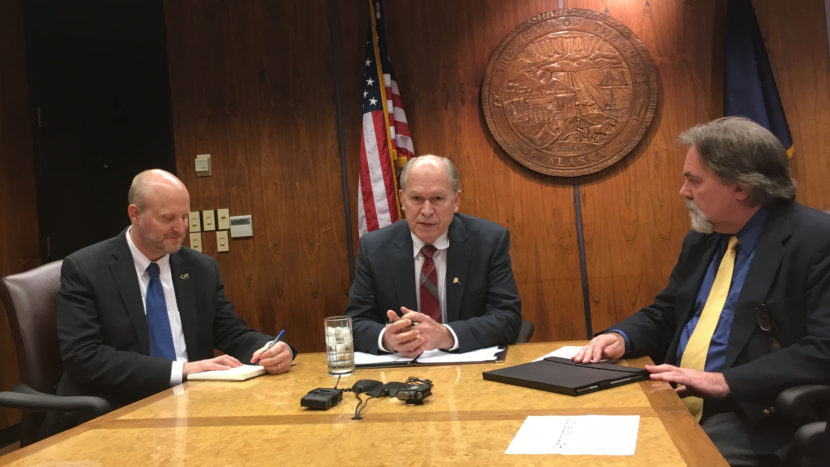

Walker said in a Capitol press availability Wednesday that he likes that there’s been movement in the Legislature on oil and gas taxes. But he’s concerned about some of the bill’s contents.

“We don’t want to be a situation where we’re pitting … producers against the independents, those that are coming in on the exploration side,” Walker said.

The bill would phase out a type of tax credit based on net operating losses. In addition, the bill scales back oil and gas tax credits at a slower pace than Walker has proposed.

“The longer we put this off, the longer we stay in this period of deficit spending,” Walker said.

While Walker would like to see the tax credits scaled back quicker, that doesn’t mean the bill satisfies the industry’s concerns. Alaska Oil and Gas Association President and CEO Kara Moriarty said scaling back tax credits will discourage oil and gas companies from investing in the state.

“If the State of Alaska changes the policy, we will respond accordingly,” she said.

Moriarty has said that an earlier version of the bill would particularly harm investment in Cook Inlet. The new version also would eliminate tax credits in Cook Inlet, but at a slower pace than the Senate bill, which Moriarty described as a “nuclear bomb.”

“The House Rules version is still a bomb,” Moriarty said, adding: “It may not be nuclear.”

Oil and gas industry expert Larry Persily said the criticism coming from both Walker and the industry reflects the issue’s contentiousness. Persily is an adviser to Kenai Peninsula Borough.

“It is clearly an attempt to try to find enough votes, because there’s not enough votes for any plan at the moment. And clearly, not enough votes for this one, either,” Persily said.

The governor’s bill would save the state up to $720 million more over the next two years than the House Rules version of House Bill 247. Walker says that if the oil and gas tax bill doesn’t include these savings, the state would have to come up with the savings somewhere else. Persily said the differences over the oil and gas tax issue are predictable.

“Getting into oil taxes, whether it’s credits or tax rates or minimums or deductions, you know, that is the big battle in Alaska,” Persily said.

Walker’s fiscal plan and the current bills either passed or being considered by the Legislature are nearly a billion dollars apart this year. Considering the governor and the Legislature’s majorities remain far apart on an income tax and other tax increases, it doesn’t look like the session will end any time soon.