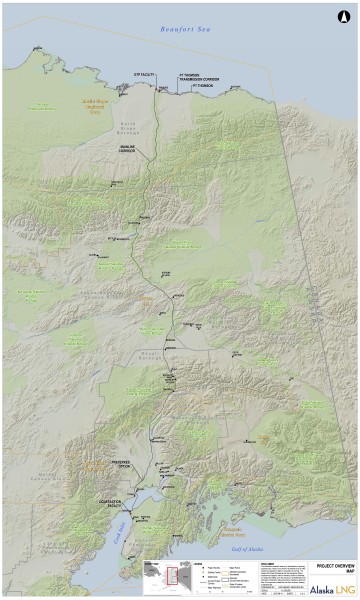

This month, the state committed to another year of work on the Alaska liquefied natural gas project. That’s the effort to bring natural gas from the North Slope to the Kenai Peninsula for export.

But natural gas prices have been plunging along with oil. In the Asian spot market, gas is selling for a third of what it did two years ago.

Should Alaska be worried?

Larry Persily says it’s true: the global market for natural gas is not so good right now.

“It’s wretched, it’s miserable, it’s lousy, it stinks,” he said. “There’s way more gas than there is demand … it’s like oil!”

Persily is a former federal official who now advises the Kenai Peninsula Borough.

The good thing, he says, is Alaska isn’t trying to sell gas into this market.

“If everything goes well, on schedule, no problems, no lawsuits, no big delays,” Persily said.

Then the first LNG tanker wouldn’t sail from Nikiski until 2024 – maybe 2025. The big question is what will the market look like then?

“It’s certainly going to be much different than it is today,” Persily said. “Don’t exactly know how, but guaranteed it will be different.”

And how you think the market will be different decides what you think of Alaska’s gas project.

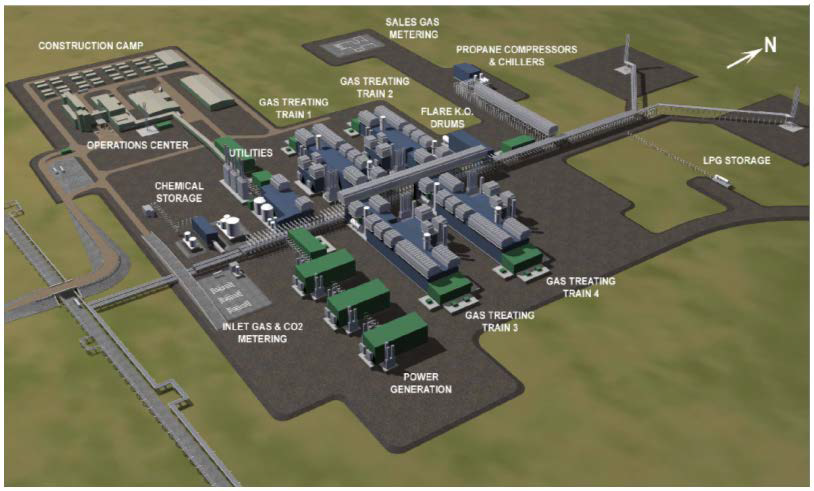

The important thing to remember about Alaska’s massive natural gas pipeline is that, as of right now, it’s an imaginary pipeline. It’s an imaginary pipeline with a right of way and an export permit and the tentative backing of three of the world’s biggest oil companies and the state of Alaska – but, still, right now it only exists on paper.

But this imaginary gas line is eating up some very real money. In the next year, Alaska and its partners – ExxonMobil, BP and ConocoPhillips – will spend $230 million just on early design and permitting. Alaska’s share of that is about $60 million.

That’s on top of the $65 million spent to buy out the pipeline builder TransCanada and reimburse its costs.

The state argues this is a good investment.

“Because if we don’t expend it, I can guarantee you, we will not have an LNG project,” Marty Rutherford, Deputy Commissioner at the state Department of Natural Resources, said.

She says the gas line is essential for Alaska’s economic future.

“Is it risked money? Yes, it is very risked money,” Rutherford said. “This is the riskiest money that will ever be spent on any project: it’s before you know you’ve actually got an economic project … is there absolute certainty? Can I warrant this project will happen? No. No one can. No one will.”

But, Rutherford says, the project has a lot going for it.

Alaska is closer to Asian markets than the U.S. Gulf Coast, or the Middle East. It’s reliable. It has proven reserves – we’ve actually seen the gas, as it’s been re-injected in the North Slope oil fields. And Alaska’s project has the backing of three major companies, with all the resources and experience they bring to bear.

That’s enough to be competitive, Rutherford says. But others say that’s wishful thinking.

“I’m laughing because I have been a supporter of the Alaskan LNG project when I still had black hair…long time,” Charles Ebinger said. He’s a senior fellow at the Brookings Institution in

Washington D.C. And these days, he doesn’t have such a rosy view.

Ebinger says the Asian market that Alaska is targeting is awash in natural gas, and will be for a long time to come. That will keep prices too low to make an Alaska project economical.

“And I know the state argues differently, and their boosters are good diplomats, and they go to Japan and they go to Korea, but I think the reality is, you gotta have LNG prices up at least $16 per million BTU, and for a sustained period of time, for that project to get built,” Ebinger said.

For reference, as of mid-December, LNG is selling at less than half that amount on the Japanese spot market.

Rutherford wouldn’t say what she thinks the state’s break-even price is, but Persily says he thinks Ebinger’s number is too high.

Meanwhile, when the International Energy Agency presented its 2015 forecast in London this fall, director Fatih Birol said that gas is being squeezed in Asia – with cheap coal on one side, and on the other, renewables, which are becoming more competitive – with a healthy push from government subsidies.

Birol said he does expect Asian demand for LNG to grow. It’s just that every project in the world is scrambling to fill that demand.

“Everybody’s eyes are on this 400 (billion cubic meters) … the entire gas industry,” Birol said. “From Australia, to U.S., to Russia, to East African exporters.”

Persily says, that’s true.

“There’ll be demand, the question is, is it going to be enough and can we be cost competitive enough,” Persily said. “Someone’s going to build an LNG project in the next 10 years – probably, half a dozen.”

The question is, whether one of those will be in Alaska.